Ever felt like you’re on the brink of securing that mortgage deal, but something’s missing? That something might be the emotional and consistent touchpoint only an email drip campaign can provide.

What is an Email Drip Campaign?

Imagine watering a plant, giving it just the right amount at the right times, ensuring its growth. An email drip campaign is much like that. It’s a series of pre-written emails sent automatically based on specific timelines or subscriber actions. Sounds robotic? It’s anything but!

Why Email Drips are Crucial for Mortgage Professionals

Let’s face it: The mortgage industry is competitive. Staying top-of-mind is paramount. But how do you do that without being pushy? Mortgage professional automations! They’re your silent warriors, working in the background, reminding your prospects of the dream they’re chasing.

The 7 Effective Email Drip Campaigns

| Campaign | Subject Line – Version 1 |

Tone | Subject Line – Version 2 | Tone |

| Welcome Series | Welcome to [Your Mortgage Company Name] – Your Home Journey Begins! | Warm | Jumping Into Your Home Journey with [Your Mortgage Company Name]! | Welcoming |

| Educational Series | Mortgages 101: Unraveling the Myths | Informative | Demystifying Mortgages: Unpacking the Basics | Clarifying |

| Testimonial Showcase | Sarah’s Dream Came True. Yours Can Too! | Inspirational | Meet John: From Dreaming to Homeowning! | Uplifting |

| FAQ Series | Got Questions? We’ve Got Answers! | Helpful | Tackling Your Top Mortgage Questions! | Engaging |

| Loan Update Series | Hot Off the Press: Latest Loan Rates! | Informative | Fresh Updates: This Week’s Loan Rates! | Current |

| Special Offer Announcements | Exclusive Offer Just For You! | Exclusive | Limited-Time Offer Awaits You! | Urgent |

| Personalized Check-ins | Just Checking In, [Subscriber’s Name] | Caring | How’s the Home Search, [Subscriber’s Name]? | Personal |

Campaign 1: Welcome Series

It’s like meeting someone at a party. Your welcome email sets the tone. Be friendly, be informative, be memorable.

Crafting the Perfect Welcome Email

Remember your first day at school? The nerves? Make your subscribers feel at ease. Introduce yourself, your mission, and perhaps, share a personal story or two. Who doesn’t love stories, right?

Campaign 1 – Example 1 “Warm”

Subject: Welcome to [Your Mortgage Company Name] – Your Home Journey Begins!

Hey there,

Welcome aboard! 🏠✨

I’m [Your Name], your friendly mortgage guide. Remember your dream of that cozy little house with a backyard or that urban condo with a skyline view? We’re here to turn that dream into reality. But before we dive in, here’s a little about me: I’m a coffee lover, weekend hiker, and your biggest cheerleader on this home-buying journey.

Stay tuned. We’re in this together!

Warmly,

[Your Name]

Campaign 1 – Example 2 “Welcoming”

Subject: Jumping Into Your Home Journey with [Your Mortgage Company Name]!

Hey there,

A warm welcome to you! 🏡✨

It’s [Your Name] here, ready to guide you through the maze of mortgages. Imagine that dream home of yours – whether it’s that suburban house with a white picket fence or a chic urban apartment. We’re here to help make that a reality. A quick thing about me: I’m a tea enthusiast, love my dog Max, and am super excited to be a part of your home journey.

Stay with us. We’re in it together!

Cheers,

[Your Name]

Campaign 2: Educational Series

Mortgages can be tricky. Your subscribers are thirsty for knowledge. Quench their thirst with bite-sized, digestible chunks of information. Charts, infographics, maybe even a meme or two – make learning fun!

Campaign 2 – Example 1 “Informative”

Subject: Mortgages 101: Unraveling the Myths

Hey [Subscriber’s Name],

Mortgages can feel like a maze, right? But guess what? You’re not alone. Today, let’s debunk some myths together.

Myth 1: The lower the interest, the better? Not always! Sometimes, lower rates come with hidden fees. Always read the fine print!

Keep an eye out for our next email, where we’ll tackle another mortgage mystery. And hey, questions? Just hit reply.

To more learning,

[Your Name]

Campaign 2 – Example 2 “Clarifying”

Subject: Demystifying Mortgages: Unpacking the Basics

Hello [Subscriber’s Name],

Ever felt that mortgages are complex? You’re not the only one. Let’s simplify things together, shall we?

Fact 1: It’s a myth that the lowest interest is always the best. Sometimes, there might be hidden charges lurking. Be sure to understand the details!

Stay tuned for our next mail, where we delve deeper. And remember, I’m just an email away if you have any questions.

Happy learning,

[Your Name]

Campaign 3: Testimonial Showcase

Hearing someone else’s success story can be just the push a potential client needs. Showcase your star clients, their journeys, and how you were pivotal in their success.

Campaign 3 – Example 1 “Inspirational”

Subject: Sarah’s Dream Came True. Yours Can Too!

Hi [Subscriber’s Name],

Sarah, like many of us, dreamt of a beachfront house. With a bit of guidance and the right mortgage plan, she’s now waking up to ocean sounds. 🌊

“Working with [Your Company] made the complex simple. I’m not just a homeowner; I’m living my dream!” – Sarah

Your dream home is waiting. Let’s make it happen!

Cheers,

[Your Name]

Campaign 3 – Example 2 “Uplifting”

Subject: Meet John: From Dreaming to Homeowning!

Hi [Subscriber’s Name],

John dreamt of a home near the mountains. With some guidance and the right mortgage, he’s now enjoying those mountain sunsets.

“Navigating mortgages with [Your Company] was a breeze. I’m not just a homeowner; I’m living my best life!” – John

What’s your dream? Let’s make it come true!

Best wishes,

[Your Name]

Campaign 4: FAQ Series

There’s no such thing as a dumb question. But there are frequently asked ones! Anticipate these questions, and drip them answers.

Campaign 4 – Example 1 “Helpful”

Subject: Got Questions? We’ve Got Answers!

Hello [Subscriber’s Name],

One question we often hear is: “Do I need a 20% down payment?” Short answer? No! There are numerous plans with lower down payments. We’re here to find what’s best for you.

Stay curious, and keep those questions coming!

Best,

[Your Name]

Campaign 4 – Example 2 “Engaging”

Subject: Tackling Your Top Mortgage Questions!

Hello [Subscriber’s Name],

One frequent question we get is: “Is a 20% down payment mandatory?” In a nutshell? No! There are numerous options available, and we can help you find the best fit.

Keep those questions coming!

Warm regards,

[Your Name]

Campaign 5: Loan Update Series

Who doesn’t like to be in the know? Keep your subscribers updated on the latest loan rates, market trends, and more. Knowledge is power!

Campaign 5 – Example 1 “Informative”

Subject: Hot Off the Press: Latest Loan Rates!

Hey [Subscriber’s Name],

Want to be in the know? Here are this week’s top loan rates. Whether you’re considering a new mortgage or refinancing, we’ve got you covered.

Remember, it’s not just about the rates. It’s about the right plan. Let’s chat?

Until next time,

[Your Name]

Campaign 5 – Example 2 “Current”

Subject: Fresh Updates: This Week’s Loan Rates!

Hi [Subscriber’s Name],

Want the latest scoop? Here are this week’s trending loan rates. Whether you’re thinking about a fresh mortgage or considering refinancing, we’re here to guide.

Always remember, the best decision is an informed one. Fancy a chat?

Until our next update,

[Your Name]

Campaign 6: Special Offer Announcements

Have a new offer? Or a limited-time discount? Your email list should be the first to know. Make them feel special; after all, they are!

Campaign 6 – Example 1 “Exclusive”

Subject: Exclusive Offer Just For You!

Hello [Subscriber’s Name],

Because you’re special to us, we’re offering an exclusive mortgage consultation FREE for the next 48 hours. Yes, you heard right! Let’s dive deep and find the best path for you.

Grab this before it’s gone!

[Your Name]

Campaign 6 – Example 2 “Urgent”

Subject: Limited-Time Offer Awaits You!

Hey [Subscriber’s Name],

As a token of our appreciation, we’re offering a complimentary mortgage consultation for the next 72 hours. Surprised? It’s all because you’re valued!

Snap this up before it’s too late!

[Your Name]

Campaign 7: Personalized Check-ins

Ever had a friend check in on you just because? That warm, fuzzy feeling? Give that to your subscribers. A simple “how’s your home search going?” can go a long way.

Campaign 7 – Example 1 “Caring”

Subject: Just Checking In, [Subscriber’s Name]

Hey there,

It’s been a while since we chatted. How’s your home search going? Remember, whether it’s answering questions or providing guidance, I’m here. Your dream home is just around the corner.

Hoping to hear from you,

[Your Name]

Campaign 7 – Example 2 “Personal”

Subject: How’s the Home Search, [Subscriber’s Name]?

Hi there,

Time flies, doesn’t it? Just wanted to check in and see how things are going on your end. If you have any queries or need any guidance, remember, I’m here for you. Your dream dwelling awaits!

Hope to hear from you soon,

[Your Name]

Tips for Crafting Engaging Emails

Addressing Pain Points

Put yourself in your subscriber’s shoes. What keeps them up at night? Address it, solve it, be their hero.

Using Persuasive Language

Words are powerful. The right ones can make all the difference. Craft your emails like you’re speaking to a friend, advising them. Be genuine, be persuasive.

Conclusion

Bringing It All Together

The power of connection can’t be understated. And what better way to connect than by being a consistent, informative, and warm presence in someone’s inbox? Remember, every email is an opportunity. An opportunity to connect, to inform, to convince. Use it wisely, and those mortgage closings? They’ll just be the cherry on top!

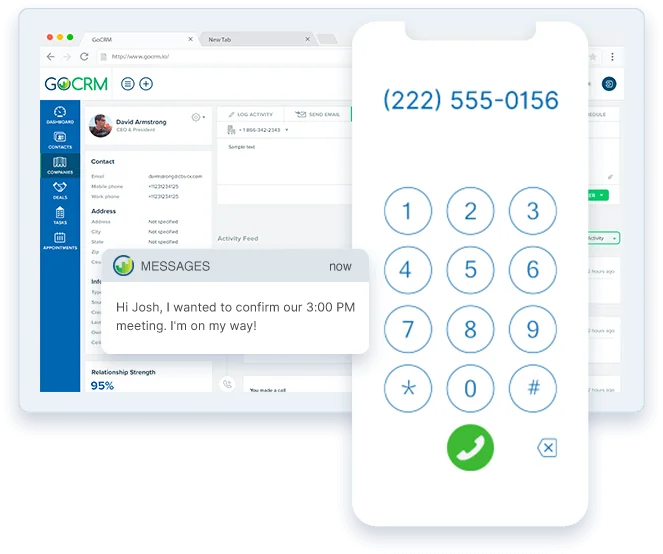

Your mortgage CRM can save

Your mortgage CRM can save  Almost half (46 percent) of borrowers never look at more than one lender before closing on their mortgage. Losing a lead means losing the sale, probably for good. Capture every possible lead with a mortgage CRM that tracks your leads for you.

Almost half (46 percent) of borrowers never look at more than one lender before closing on their mortgage. Losing a lead means losing the sale, probably for good. Capture every possible lead with a mortgage CRM that tracks your leads for you. A CRM customized for the mortgage industry does more than prevent wasted marketing dollars. It also maximizes the impact of those dollars by delivering more leads and conversions for your mortgage business.

A CRM customized for the mortgage industry does more than prevent wasted marketing dollars. It also maximizes the impact of those dollars by delivering more leads and conversions for your mortgage business.

A lead management system helps you with lead management by acting as an organized platform in which incoming leads are qualified and nurtured to be converted into new business opportunities.

A lead management system helps you with lead management by acting as an organized platform in which incoming leads are qualified and nurtured to be converted into new business opportunities.

Send emails to leads with automated

Send emails to leads with automated